SMS-iT CRM offers a comprehensive suite of lead management tools designed specifically for the mortgage lending industry. These tools are designed to streamline the loan approval process, improve communication between borrowers and lenders, automate workflows, leverage data analytics, and ensure compliance with regulatory requirements. In today’s competitive mortgage lending market, efficient lead management is crucial for success.

Lead management is the process of capturing, tracking, and nurturing leads throughout the sales cycle. In the mortgage lending industry, this involves managing potential borrowers from the initial contact through the loan approval process. Effective lead management can significantly improve conversion rates and increase revenue for mortgage lenders.

Key Takeaways

- SMS-iT CRM offers lead management tools for mortgage lenders

- Accelerating mortgage loan approvals is crucial in the competitive market

- Understanding the loan approval process is important for lenders

- SMS-iT CRM’s tools can streamline lead generation, communication, and automation

- Leveraging data analytics can improve loan approval rates for lenders

The Need for Accelerating Mortgage Loan Approvals

The mortgage loan approval process can be lengthy and complex, with numerous challenges that can cause delays. These challenges include gathering and verifying documentation, conducting credit checks, appraising properties, and coordinating with various parties involved in the process. These delays can have a significant impact on both borrowers and lenders.

For borrowers, delayed loan approvals can mean missed opportunities to purchase their dream homes or refinance at lower interest rates. It can also lead to increased stress and uncertainty during the home buying process. For lenders, delayed loan approvals can result in lost business opportunities, decreased customer satisfaction, and increased costs associated with extended processing times.

Understanding the Mortgage Loan Approval Process

The mortgage loan approval process typically involves several steps, each with its own set of requirements and stakeholders. The first step is pre-qualification, where potential borrowers provide basic information about their financial situation to determine their eligibility for a loan. This is followed by the loan application process, where borrowers submit detailed financial information and documentation.

Once the application is submitted, it goes through a review process where lenders verify the information provided by the borrower and assess their creditworthiness. This includes conducting credit checks, verifying employment and income information, and appraising the property being financed. If the application meets the lender’s criteria, it moves on to the underwriting process, where a final decision is made on whether to approve the loan.

How SMS-iT CRM’s Lead Management Tools Can Help

SMS-iT CRM’s lead management tools can greatly assist mortgage lenders in streamlining the loan approval process and improving overall efficiency. These tools provide a centralized platform for managing leads, automating workflows, and leveraging data analytics to make informed decisions. By using SMS-iT CRM’s lead management tools, mortgage lenders can benefit from increased productivity, improved communication, and higher loan approval rates.

Streamlining Lead Generation and Qualification

One of the key features of SMS-iT CRM’s lead management tools is their ability to streamline lead generation and qualification. These tools allow mortgage lenders to capture leads from various sources, such as websites, social media, and referrals, and automatically import them into the CRM system. This eliminates the need for manual data entry and ensures that no leads are missed.

Once leads are captured, SMS-iT CRM’s tools provide advanced lead qualification capabilities. These tools can automatically score leads based on predefined criteria, such as credit score, income level, and loan amount. This allows mortgage lenders to prioritize leads and focus their efforts on those with the highest likelihood of conversion.

Accurate lead qualification is crucial in the loan approval process as it helps lenders identify potential risks and make informed decisions. By using SMS-iT CRM’s lead management tools, mortgage lenders can ensure that they are targeting the right borrowers and maximizing their chances of success.

Enhancing Communication with Borrowers and Lenders

Effective communication is essential in the mortgage loan approval process. Borrowers need to be kept informed about the status of their applications, while lenders need to communicate with various parties involved in the process, such as appraisers, underwriters, and title companies. SMS-iT CRM’s lead management tools can greatly enhance communication between borrowers and lenders.

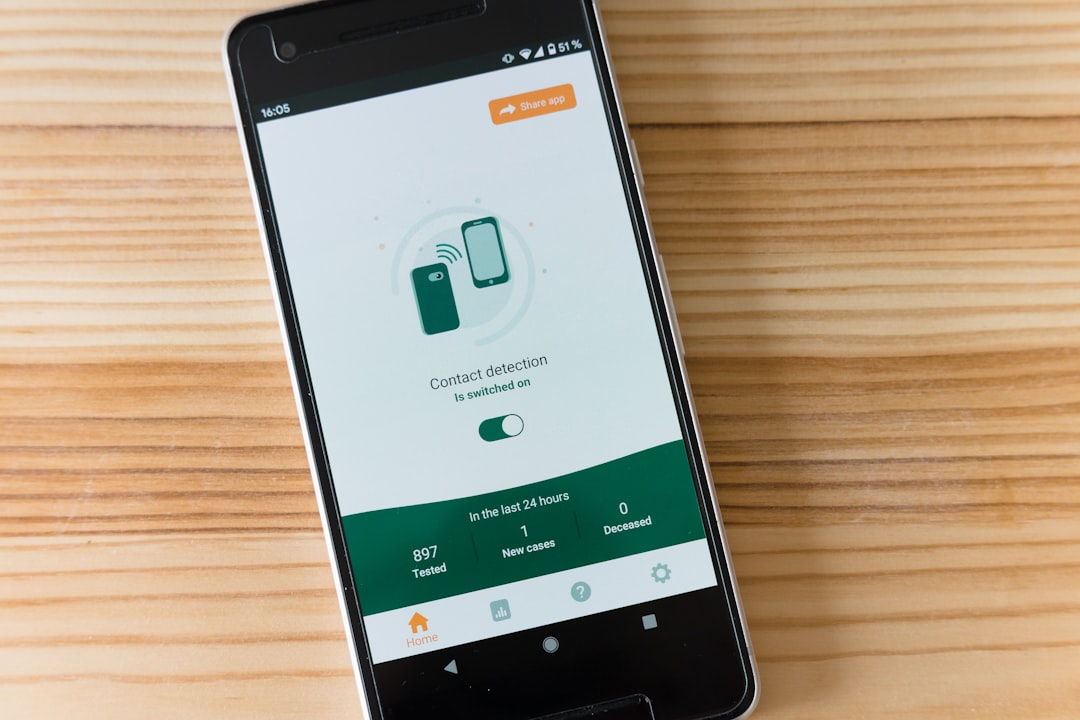

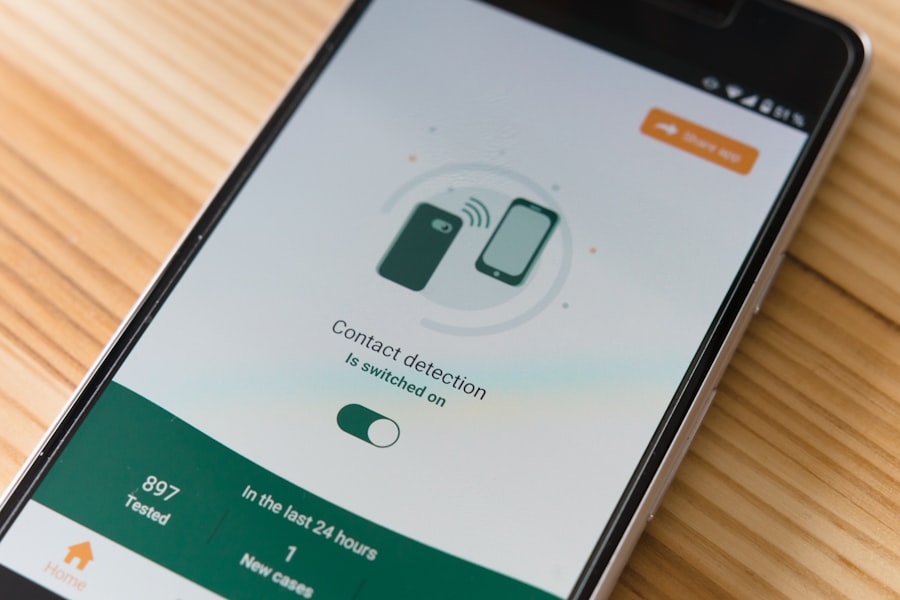

These tools provide a centralized platform for managing all communication related to the loan approval process. Borrowers can receive automated updates on the status of their applications, request additional information, and communicate with lenders through various channels, such as email, SMS, and chat. Lenders can also use these tools to send reminders, request documentation, and coordinate with other parties involved in the process.

By improving communication, SMS-iT CRM’s lead management tools can help reduce delays and ensure that all parties are on the same page. This leads to a smoother loan approval process and increased customer satisfaction.

Automating Loan Application and Approval Workflows

Another key feature of SMS-iT CRM’s lead management tools is their ability to automate loan application and approval workflows. These tools can automatically generate loan application forms, populate them with borrower information, and route them to the appropriate parties for review and approval.

By automating workflows, mortgage lenders can significantly reduce processing times and eliminate manual errors. This leads to faster loan approvals and increased efficiency. Additionally, automation allows lenders to track the progress of each application in real-time, identify bottlenecks in the process, and take proactive measures to address them.

Leveraging Data Analytics to Improve Loan Approval Rates

Data analytics plays a crucial role in improving loan approval rates. By analyzing historical data and identifying patterns, mortgage lenders can make more accurate predictions about borrower behavior and make informed decisions about loan approvals. SMS-iT CRM’s lead management tools provide advanced data analytics capabilities that can help mortgage lenders improve their loan approval rates.

These tools can analyze data from various sources, such as credit reports, income statements, and property appraisals, to identify trends and patterns that may indicate potential risks or opportunities. By leveraging this data, mortgage lenders can make more accurate assessments of borrower creditworthiness and make informed decisions about loan approvals.

Ensuring Compliance with Regulatory Requirements

Compliance with regulatory requirements is a top priority for mortgage lenders. Failure to comply with these requirements can result in severe penalties, reputational damage, and legal consequences. SMS-iT CRM’s lead management tools are designed to ensure compliance with regulatory requirements in the mortgage lending industry.

These tools provide built-in compliance checks that automatically validate borrower information against regulatory databases and flag any potential issues. They also generate audit trails and reports that can be used to demonstrate compliance during regulatory audits. By using SMS-iT CRM’s lead management tools, mortgage lenders can have peace of mind knowing that they are operating within the bounds of the law.

Benefits of Using SMS-iT CRM’s Lead Management Tools for Mortgage Lenders

In conclusion, SMS-iT CRM’s lead management tools offer a wide range of benefits for mortgage lenders. These tools can streamline lead generation and qualification, enhance communication with borrowers and lenders, automate loan application and approval workflows, leverage data analytics to improve loan approval rates, and ensure compliance with regulatory requirements.

By using SMS-iT CRM’s lead management tools, mortgage lenders can increase productivity, reduce processing times, improve customer satisfaction, and ultimately increase revenue. In today’s competitive mortgage lending market, efficient lead management is crucial for success. Mortgage lenders who want to stay ahead of the competition should consider using SMS-iT CRM’s lead management tools for their loan approval process.

If you’re interested in exploring the boundless possibilities of SMS-iT CRM’s lead management tools, you might also want to check out this related article on how to boost your subscriber list with SMS-iT’s Text-to-Join feature. This simple solution offers an effective way to enhance your marketing efforts and reach a wider audience. To learn more about this innovative tool, click here.

FAQs

What is SMS-iT CRM?

SMS-iT CRM is a customer relationship management software that helps businesses manage their interactions with customers and potential customers.

How can SMS-iT CRM help with mortgage loan approvals?

SMS-iT CRM’s lead management tools can help mortgage lenders streamline their loan approval process by automating tasks such as lead capture, lead nurturing, and follow-up communication with potential borrowers.

What are the benefits of using SMS-iT CRM for mortgage loan approvals?

Using SMS-iT CRM for mortgage loan approvals can help lenders save time and money by automating repetitive tasks, improving communication with borrowers, and increasing the efficiency of the loan approval process.

How does SMS-iT CRM’s lead management tools work?

SMS-iT CRM’s lead management tools work by capturing leads from various sources such as web forms, social media, and email campaigns. The software then automates the process of nurturing these leads through targeted communication and follow-up tasks, ultimately resulting in a higher conversion rate.

Is SMS-iT CRM easy to use?

Yes, SMS-iT CRM is designed to be user-friendly and easy to use, even for those with little to no technical experience. The software also offers training and support to help users get started and make the most of its features.

Can SMS-iT CRM be customized to fit my business needs?

Yes, SMS-iT CRM is highly customizable and can be tailored to fit the specific needs of your business. The software offers a range of features and integrations that can be customized to meet your unique requirements.